Pawtucket resident? Finally be free of your tax problems, and see if you can legally get out of paying up to 90% of your tax debt

A quick 15 minutes with our BBB A+ experts can show you right now

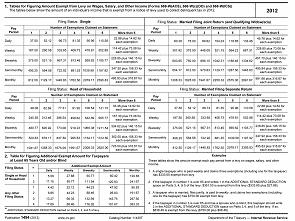

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

Proudly Serving Pawtucket, and All of Rhode Island

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Finally have relief from you back tax issues in Pawtucket, with our highly rated team

Highly Experienced Pawtucket Tax Lawyer

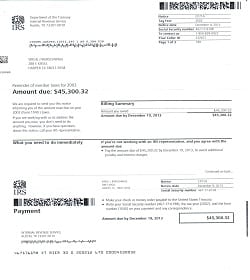

Among the worst things you can do with IRS back tax debt is continue to neglect it for many years at a time. The Internal Revenue Service wants to add on additional fees and interest charges to the quantity you owe, and certainly will stop at nothing to collect that money.

They’re the biggest collection agency in the world, and we steadfastly believe that no one should have to face them by themselves.

For most of US, having a huge government agency constantly harassing them with revenue officers and letters, notices is a terrible idea.

That is why our Pawtucket team is here to help you. You no longer have to manage the Internal Revenue Service by yourself, and certainly will have someone in your corner to help negotiate for you.

So if you owe the federal government, or the state of Rhode Island, our dedicated law firm is here to make your life simpler.

With just 15 minutes on the phone with our pros, you’ll learn what to do next, and exactly what you’ll qualify for.

Give our Rhode Island team a call today!

A seasoned law firm is your best shot of eventually being free of tax debts that are back in Rhode Island

Have you ever been fighting with your back tax debts for a number of years, and are eventually fed up with dealing with the IRS by yourself?

Have they began sending letters and notices to your residence or business, demanding you pay extra penalties and interest charges for the amount you owe?

If so is hire a tax law business that is reputable and experienced to be by your side every step of the way. The great news is, our Pawtucket firm is the right candidate for the job, with an A+ company rating with all the BBB, tens of thousands of happy customers throughout the country (especially in amazing Rhode Island), and our own team of tax attorneys, CPAs and federally enrolled representatives, all prepared to work in your case today.

The IRS is the biggest collection agency on earth, with thousands of billions and revenue officers of dollars set aside to pursue good, hard working people like you for the money you owe. You should not have to face them by yourself. We don’t get intimidated about like ordinary citizens can use our private contacts to negotiate the resolution that you need, and do.

Using experienced Pawtucket legal counsel on your tax dilemmas is like having an expert plumber come and fix your massively leaking water main.

So do yourself, your family as well as your future a a favor now, and let our Pawtucket law firm help you with your back tax issues right away. Our crew of experts is standing by, ready to help you!

Our Pawtucket team can remove your wage garnishment within 24-48 hours

What is a Garnish of Wages?

In the event you owe the IRS back taxes and don’t respond to their phone calls or payment notices chances are that you may be subjected to an IRS wage garnishment. In other quarters, it is also known as a wage levy or wage attachment. It is worth noting that a court order is usually not needed and other state and federal laws pertaining to the whole sum of exempted from garnishment does provide several exceptions for the wage levies.

The garnishment process is usually quite long, first the IRS discovers how much you owe them in back taxes, after this has been done, they’ll send you several payment request notices in the email as well as more than one phone call with regards to the debt in question. Failure to react to the phone calls and notices,automatically leads to a ‘Notice of Intention to levy” being sent to your last known mailing address. You typically have thirty (30) days to get in touch with IRS with regards to this notice before they go ahead and forwarding the notice to your Pawtucket company. After this notice was sent to the Pawtucket company, you have a further fourteen (14) days to make a reply before garnishment of wages starts. The company generally has at least one pay period before they may be required to send the money, after receiving a notice of levy.

How Much Can they Garnish from My Wages?

IRS garnishment rules generally allow the Internal Revenue Service to deduct or garnish 70% or more of an employee’s wages; this is largely done with the aim of convincing the employee or his representative to get in touch with IRS to settle the debt.

Wage garnishments are usually one of the very aggressive and harsh tax collection mechanics and one should never take them lightly, as a matter of fact, they’d rather resolve tax problems otherwise and just sanction this levy when they believe they have ran out of viable alternatives. Though paying off the taxes you owe the IRS is the simplest way out of such as scenario, this is normally not possible because of wide selection of reasons. First of all, you may not have the tax liability or the whole amount may belong to your ex spouse or someone else, you’ll be asked to prove this though.

What should I do about garnishment?

You thus have to discuss any payment arrangements with the Internal Revenue Service and do so fairly quick. In this regard, it is critical that you get in touch with an expert who will help you stop or end the garnishment and to readily obtain a wage garnishment discharge. We’re a Pawtucket BBB A+ rated tax firm with a team of tax lawyers that are exceptionally competent with years of experience as well as a long record of satisfied clients to prove this. Touch base with us and we promise to get back to you within the shortest time possible, generally within one working day or less. We assure that will help you achieve an amicable arrangement together with the Internal Revenue Service(IRS) and get you a wage garnishment discharge.

Let our Rhode Island team which means you are able to afford to repay your debt over time negotiate a payment plan for you

This arrangement allows for monthly payments to be made. So long as the citizen pays their tax debt in full under this particular Agreement, they avoid the payment of the fee that’s associated with creating the Arrangement and can reduce or eliminate the payment of fees and interest. Creating an IRS Installment Agreement requires that all necessary tax returns are filed prior to applying for the Arrangement. The taxpayer cannot have some unreported income. In some instances, a citizen may request a longer period than 72 months to pay a tax debt of $50,000 or less. back

Good Parts about an Payment Plan

The agreement will bring about some important gains for the taxpayer. While an arrangement is in effect, enforced collection activity WOn’t be taken. Life will be free of IRS letters and notices. When the taxpayer can count on paying a set payment every month rather than having to worry about putting lump sum amounts on the tax debt, there is going to be more fiscal independence. The citizen will eliminate interest and continuing IRS fees. The IRS will assist in the event the taxpayer defaults on a payment supplying the IRS is notified promptly, the citizen keep the agreement in force.

Problems with the Installment Plan

Some obligations come with the Installment Agreement. The minimum monthly payment should be made when due. The income of the incomes of taxpayers that were joint or an individual citizen must be disclosed when applying for an Installment Agreement. Sometimes, a financial statement should be supplied. All future returns must be filed when due and all of the taxes owed with these returns should be paid when due. This way of making monthly payments enable the citizen to request the lien notice be removed. However, the lien could be reinstated in the event the taxpayer defaults on the Installment Agreement.

The citizen and the IRS can negotiate an Installment Agreement. Nonetheless, specific advice must be provided and any information could be subject to affirmation. For citizens a financial statement will be required.

How to Prepare to Apply

While citizens can apply for an IRS Installment Agreement, there are some precautions that should be considered. There are some circumstance which can make this a challenging job although the IRS tries to make using for an Installment Agreement a relatively easy process. Since many problems can be eliminated by an Installment Agreement with the IRS, it is vital to get it right the first time the application is made.

We’re the BBB A+ rated law firm serving all of Pawtucket and Rhode Island, which may provide skilled support to you. Our many years of expertise working on behalf of taxpayers that have problems with the IRS qualifies us to ensure approval of your application for an Installment Agreement.

Avoid being conned by a Rhode Island tax relief company, and let our BBB A Rated team help you

A lot of people are law abiding Pawtucket citizens and they dread the dangers of IRS action. Innocent people are lured by these firms in their scams and commit consumer fraud and even theft! Therefore, care should be exercised by you when you are trying to locate a tax resolution business for yourself.

What Tax Relief Scams will do

Not all Rhode Island tax relief companies who guarantee to negotiate together with the IRS for you’re trustworthy. Because there are so many fraudulent businesses out there, thus, averting IRS tax help scams is vitally important. It’s possible to prevent being taken advantage of, all you have to do to follow a number of useful suggestions and is to train yourself in this regard! An authentic tax resolution company will always folow a mutually satisfactory financial arrangement wherein the payments can be made on a weekly, bi-weekly monthly or basis.

Secondly, it’s advisable to be somewhat careful when you’re choosing a certain tax resolution firm to work with. Should they guarantee you the desired results or state that you qualify for any IRS program without going through a complete fiscal analysis of your current situation then chances are the business is deceptive. After all, without going through your comprehensive fiscal analysis first, it’s not possible for companies to pass such judgment. Hence, don’t fall for their sugar coated promises and search for other genuine companies instead.

How to find out about a tax relief firm

The internet is a storehouse of information, but you should be cautious about using such information. Do not just hire any haphazard firm with good ads or promotional campaigns for handling your tax related problems. To be able to choose the right company, it is wise to study about the same in the Better Business Bureau web site and see their ratings or reviews. Thus, doing your assignments and investing time in research is definitely a sensible move here.

A website with an excellent evaluation on BBB is definitely one that you can put your trust in. We are a BBB A+ rated Pawtucket business, we help people by alleviating their IRS back tax debts. Our tax options are reasonable, in order to ensure that your tax debts are eliminated, we do not only negotiate for your benefit together with the Internal Revenue Service, but rather create a practical strategy. Thanks to our vast experience and expertise in the field, you can rest assured your tax problems would be solved effectively and promptly when you turn to us for help.

Has the IRS been sending letters and notices to you? Desire that to stop immediately? We can help.

IRS Letters and Notices are sent to individuals in Pawtucket who haven’t paid all of their tax obligation or haven’t filed their tax returns. The IRS is responsible for collecting taxes due from citizens to make sure that the Federal Government has the funds to run its business. The IRS assumes that taxpayers who are delinquent in filing their tax returns and who neglect to pay their taxes are dismissing the reason taxes are not unimportant. The Internal Revenue Service also presumes that taxpayers would not have a great reason for not fulfilling their tax obligations. Competitive pursuit of these taxpayers is the reason why IRS letters and notices are sent. People who have filed their tax returns but haven’t paid all of the taxes which are due, may also get IRS letters and notices. For do speedy group action delinquent citizens are on the Internal Revenue Service radar. Taxpayers must recall the IRS does not need to commence any court action to impose wages, bank accounts and property. Even pension income can be attached.

Many IRS letters and notices are sent to impose a penalty on the taxpayer. Penalties are prolific. The different of fees is 10 times that amount, although in 1988, there were only 17 penalties that the IRS could impose. Some of these can certainly become serious issues for the taxpayer.

Examples of Letters

Notice of Under-Reported Tax Debt

A notice that maintains a taxpayer has under reported their income is a serious matter. Frequently, this could be accommodated easily, but the citizen will be evaluated a fee along with interest if the IRS claim is valid. Then the taxpayer could be accused of filing a fraudulent return, whether this notice spans more than one year of tax filings. The interest along with the fees will amount to an unbelievable sum of money no matter the perceived intent.

Wage Garnishment

A notice that threatens to attach a taxpayer’s wages, bank account or property is serious. Letters which were sent to the taxpayer in an effort to solve the delinquency before it achieves the collection action are followed by this notice.

Property Lien

A notice stating the IRS has filed a lien on the citizen’s property also follows letters of intent to take this actions. The notice will include the amount of the lien along with the governmental bureau where it was recorded. This lien will avoid the taxpayer from selling the property until the lien is filled, or the lien amount will be deducted from the proceeds of a sale. The IRS can also compel the selling of the property to obtain fulfillment of the lien. A notice will be issued if a deal is planned.

What you should do because of a notice

The citizen should never ignore IRS letters and notices. Instead, they ought to immediately seek help with these possible dangers to their financial security. Actually, if a citizen who considers they may receive letters and notices from the IRS can contact us so we can stop these from being sent. Contacting our BBB A+ Pawtucket law firm is even more significant if a letter or notice has been received. We have many years of successful experience in working with the Internal Revenue Service and state of Rhode Island to resolve taxpayer problems.

Other Cities Around Pawtucket We Serve

| Address | Pawtucket Instant Tax Attorney175 Main Street, Pawtucket, RI 02860 |

|---|---|

| Phone | (401) 648-3883 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Pawtucket We Serve | Albion, Barrington, Bristol, Central Falls, Chepachet, Clayville, Coventry, Cranston, Cumberland, East Greenwich, East Providence, Fiskeville, Forestdale, Foster, Glendale, Greenville, Harmony, Harrisville, Hope, Johnston, Lincoln, Manville, Mapleville, North Kingstown, North Providence, North Scituate, North Smithfield, Oakland, Pascoag, Pawtucket, Providence, Prudence Island, Riverside, Rumford, Slatersville, Smithfield, Tiverton, Warren, Warwick, West Warwick, Woonsocket, Assonet, Attleboro, Attleboro Falls, Bellingham, Berkley, Blackstone, Chartley, Dighton, East Mansfield, East Taunton, Easton, Fall River, Foxboro, Franklin, Hopedale, Mansfield, Medway, Mendon, Millville, Norfolk, North Attleboro, North Dighton, North Easton, North Uxbridge, Norton, Plainville, Raynham, Raynham Center, Rehoboth, Seekonk, Sheldonville, Somerset, South Easton, South Walpole, Swansea, Taunton, Uxbridge, Wrentham |

| City Website | Pawtucket Website |

| Wikipedia | Pawtucket Wikipedia Page |